Wire Fraud: Be Aware!

Wire Fraud On the Rise

Wire fraud has been on the rise in the past few years. Since real estate is an industry where large amounts of money are involved, many scammers are increasingly devoting their efforts to target home purchases. According to the FBI, cyber-criminals stole or tried to steal about $19 million from real estate transactions in 2016. That number went up to almost $1 billion in 2017. That’s a huge jump for one year.

What Is Wire Fraud?

Wire fraud is when criminals steal money by having people wire, or send, money to a fraudulent account. How do they do this? They usually find ways to pose as an agent, escrow officer, or mortgage lender. They hack into email accounts and monitor email exchanges between parties to learn important details about the transaction. Then, at the perfect moment, the criminals jump in and send doctored emails to look exactly like they came from a trusted source. They give instructions for the money to be wired to a specific (fraudulent) account. Once the sender wires the money, there’s almost no way to trace it or get it back. The money is gone forever and the scammers get away.

Close to Home

We often see or hear these stories online but it recently happened close to home. A few weeks ago, some clients of an agent in our office lost their earnest money of $20,000 to fraudsters. Sometimes, people lose hundreds of thousands of dollars.

Our agent had had multiple conversations about only writing a check for the earnest money and not wiring it. However, 30 minutes after a real email from our agent, scammers sent an email from a fake address that was very similar to the agent’s. It had all the correct formatting and contained knowledge of the transaction. The email also contained “updated instructions” for wiring the earnest money, which the buyers followed.

It turned out the buyers’ email address had been hacked and the criminals had been watching the interactions, waiting for the perfect moment to slip in. Even if it only pays off one out of 100 times, there’s lots of money to be made and little risk of getting caught.

Ways to Stay Safe

- Don’t wire money! Write a check if you can. I know it seems like we’re going backwards here, but it truly is the safer option.

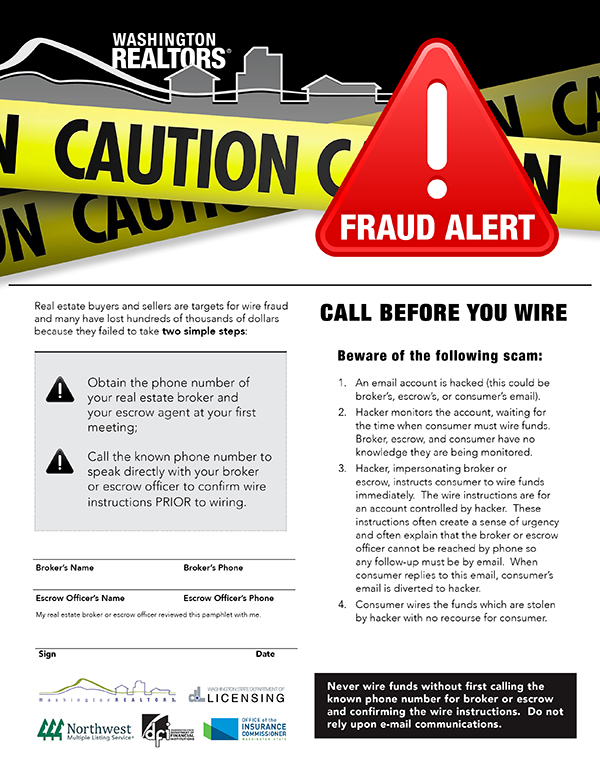

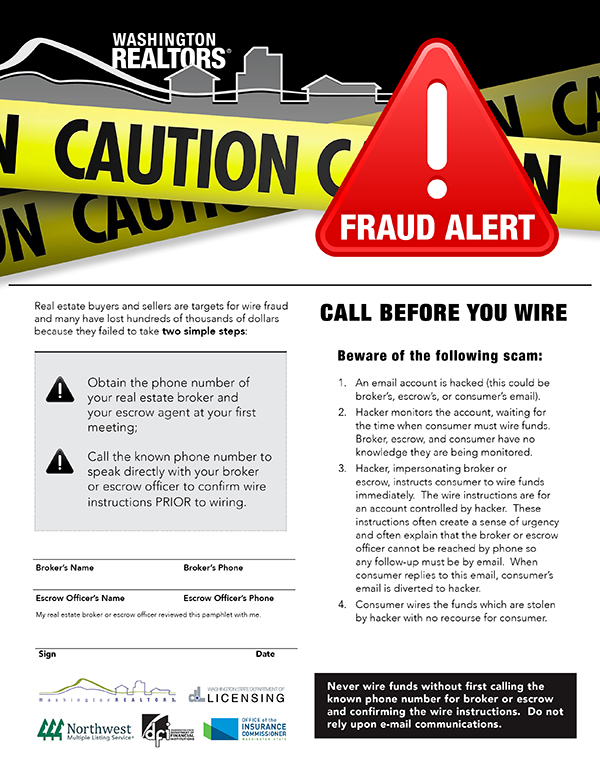

- If you have to wire money, ALWAYS verify instructions in person or over the phone with a person that you already know, through a phone number that you already know. Be especially wary of wire instructions sent via email

- Make sure you have strong passwords.

- Don’t share personal information in emails.

- Don’t click on suspicious links or emails.

Please don’t become a victim of these criminals! The best defense is strong communication with your agent and being educated. The form below is something every agent should give you at the beginning of your agency relationship! Let me know if you have any questions or comments.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link