Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

January 2021 Housing Market Update (NWMLS Press Release)

“Extraordinary market conditions” sustain strong home sales around Washington state during holidays

Here are the bullet points from the newest press release from the Northwest Multiple Listing Service, which provides housing market data for most of Western Washington:

- “insatiable buyer demand” is keeping inventory scarce as house hunters try to outmaneuver and outbid each other

- double digit price increases in new listings, pending sales, closed sales, and prices

- “As more people are working from home, they are also purchasing properties further afield from Seattle”

- Chelan, Clallam, Grays Harbor, Kittitas, and Mason counties had year-over-year price growth of 20% or more

- “Tight listing inventory, low interest rates, and high buyer demand continue to drive momentum”

- Despite the most new listings in a December since 2010, at the end of the month total active listings system-wide in the MLS were down 44% from a year ago

- The market usually slows during the holiday season, but with fewer people traveling and not much else for buyers to focus on, the market remained competitive

- Buyers have to be creative to add value to their offers in ways other than price:

- shorter or waived contingencies

- pre-inspections

- closing date flexibility

- higher earnest money deposits

- agreeing upfront to pay the difference if a property’s appraised value is lower than the sales price

- System wide, single family home prices increased 12.9% compared to last year, where condos only rose 1.8%

- “It is most definitely a sellers’ market, and buyers should not depend on a significant increase in inventory or a decrease in prices in the coming months”

- “Have patience and prepare for multiple offer situations”

To read the full press release, click here.

Mortgage Calculator: Not The Full Equation

What is a mortgage calculator?

If you’re house hunting, then you need to know what you can afford. The first step is getting pre-approved with a mortgage lender. A pre-approval is a basically what the lender says you can afford overall, but it doesn’t tell the whole story. You’ll still want to know what your monthly payments would be. Most people use a mortgage calculator to do this. If you’ve ever used the Internet, then you’ve probably been on Zillow and/or Redfin, and you’ve probably noticed the built-in mortgage calculators they provide. These allow you to automatically see what your payments might be for a specific property.

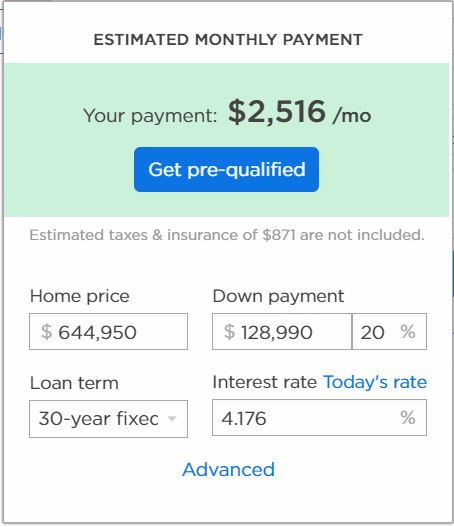

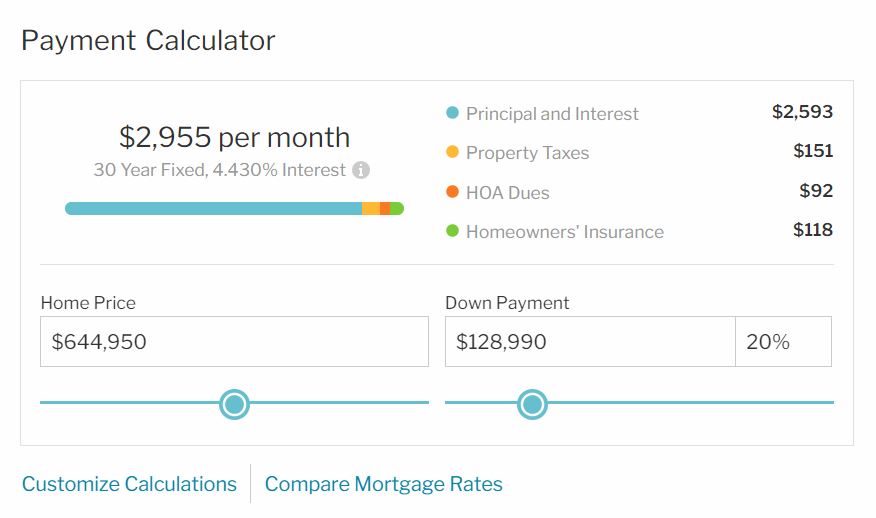

But wait, there’s more! Online mortgage calculators might be free and convenient, but many of them don’t have all the figures you need to get a good estimate of a monthly mortgage payment. At its most basic, a mortgage calculator only has the mortgage amount, which is the price of the house minus the down payment. The calculator often defaults to a 30-year loan with an interest rate pulled from elsewhere on the Internet. The resulting monthly payment you see only includes the principal and interest on the loan. This is very misleading because there are other costs that go into your monthly payments.

What’s missing?

Property taxes are the biggest omission. In Seattle, the 2018 property tax rate was $9.56 per $1,000 of assessed value, which is roughly 1% per year. So if your property was assessed at $500,000 (assessed value is often much lower than actual market value), then you would pay $4,780 in taxes that year. That alone is an extra $398 a month!

Other costs can include:

- homeowners insurance

- homeowners association dues (mostly for condos and planned communities, but these can also be hundreds of dollars a month)

- utilities

- general home maintenance and repairs

- private mortgage insurance (usually required if you put less than 20% down)

- closing costs

These can all add up to quite a bit more per month than just the sale price of the house.

How can I get a more accurate estimate?

Find a mortgage calculator that has more than just the basic calculations of mortgage amount and interest rate. If you can adjust the figures or enter your own, even better. Many websites that provide free mortgage calculators offer “advanced” versions, so look for buttons or links to those.

Conclusion (TLDR [too long, didn’t read])

Even if you’re pre-approved and know the overall price of a house you can afford, there are other costs that go into your monthly home payments. The best way to estimate your total monthly payments is to speak with your lender. If you don’t want to bother your lender about every single house you look at and you want to use a mortgage calculator on your own, make sure the calculator you use allows you to enter in your own figures. Are you comfortable with that monthly payment? If not, then you’ll have to work with your lender to reach one that you will be comfortable paying.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link