December 2020 Housing Market Update (NWMLS Press Release)

Northwest MLS brokers say real estate activity across Washington remains strong

Here are the bullet points from the newest press release from the Northwest Multiple Listing Service, which provides housing market data for most of Western Washington:

- buyer demand remains strong, while inventory is too low to satisfy the demand

- buyers must be ready to compete, and they need the right search and offer strategies

- more activity than there normally is this time of year

- across the MLS, the number of sales is up about 23% compared to a year ago

- prices are up about 14% from a year ago

- inventory is down about 43% compared to last year

- inventory for Seattle condos is actually up about 61% compared to last year, with prices rising almost 9%

- mortgage interest rates hit their lowest level for the 14th time this year, currently at 2.71% for a 30-year fixed-rate mortgage

- the so-called “COVID Effect” is causing buyers to want more space, inside and outside, for working and schooling from home

To read the full press release, click here.

November 2020 Housing Market Update (NWMLS Press Release)

Anxiety among home buyers “incredibly high” as they vie

for unpreceded shortage of homes across much of Washington state

Here are the bullet points from the newest press release from the Northwest Multiple Listing Service, which provides housing market data for most of Western Washington.

- active listings were down 40% compared to the same month last year

- pending sales were up 16% and closed sales were up 30% compared to last year

- interest rates remain historically low, offering increased affordability for buyers, which also comes at the cost of more buyers competing with each other

- Boeing’s announcement of layoffs has not shown any negative effect on the market so far

- areas outside King County are increasingly competitive and prices are rising, but still far below King County. The median price single family home in Snohomish county (excluding condos) sold for about $165,000 less than in King County (580,000 vs $745,000)

- open houses are permitted again with up to five visitors on the property at one time, in addition to the hosting broker

- condo buyers have less pressure in some parts of the market, with new listings 38% higher than last year at this time

To read the full press release, click here.

October 2020 Housing Market Update (NWMLS Press Release)

September’s home sales reached highest level since June 2018

Here are the bullet points from the newest press release from the Northwest Multiple Listing Service, which provides housing market data for most of Western Washington.

- September’s closings marked a jump of nearly 28% from the same month a year ago

- inventory is down 43% from a year ago

- pending sales are up 23% from a year ago

- prices for single family homes and condos combined are up 19% from a year ago

- it’s too soon to make any predictions about how Boeing’s announcement to move 787 production to South Carolina away from Everett will affect the Snohomish County housing market

- supply continues to be inadequate to meet demand

- in King County, the median sale price for single family homes was $754,600 (median means half sold for more, half sold for less)

To read the full press release, click here.

September 2020 Housing Market Update (NWMLS Press Release)

Would-be homebuyers have more buying power, but also more competition for meager inventory

Here are the bullet points from the newest press release from the Northwest Multiple Listing Service, which provides housing market data for most of Western Washington.

- all-time low interest rates mean home buyers have more buying power, but the lack of inventory and increasing home prices in many parts of Washington are leaving many buyers unable to take advantage of these attractive rates

- some things buyers are doing to win offers:

- waiving inspections and other protections

- paying more than a home is worth

- agreeing to pay the difference in cash between a low appraised value and the sales price

- there is rising demand for lower density housing in outer suburbs, probably due to more people being able to work remotely

- pending sales are outpacing new listings, causing months of inventory to shrink to less than a month in 9 counties

- prices are appreciating at double-digit rates in most counties in the NWMLS

- for last month’s closed sales, prices increased nearly 14% system-wide compared with a year ago

- COVID conditions have had little or no effect on buyers and sellers closing transactions.

To read the full press release, click here.

August 2020 Housing Market Update (NWMLS Press Release)

Opportunities abound for home buyers and sellers, but brokers say “don’t delay”

Here are the bullet points from the newest press release from the Northwest Multiple Listing Service, which provides data for most of Western Washington.

- pent-up demand from homebuyers meant inventory remained tight

- pending sales jumped nearly 14% from a year ago

- inventory remained well below the level from last year (down about 39%)

- interest rates at historical lows mean buyers can get much more for their money (many buyers are getting rates at under 3%)

- depleted inventory means multiple offers in just about every market and at every price point

- the need for housing outweighs the fears of coronavirus

- suburban lifestyle continues to draw buyers especially with remote work becoming more common

- with low inventory, prices continue to increase, but inventory looks to be inching up

- demand will continue to far outstrip supply for quite a while

- King County median price for homes and condos up 7.2% from a year ago to $670,000

To read the full press release, click here.

Interest Rates at 12-Month Lows

Interest rates for mortgages are now around the low 4% range for a 30-year fixed loan.

There’s a general rule of thumb for interest rates that goes like this: for every 1% change in interest rates, you gain or lose 10% buying power. So if you were pre-approved to buy a $500,000 house a few months ago when rates were around 4.5%, you might now be able to afford a $525,000 house (5% more buying power).

It’s also a good time to refinance into a lower rate, which could save you tens of thousands of dollars in the long term.

Talk to your mortgage consultant today, and if you don’t have one already, I’m happy to provide references to a few that I know and trust.

February 2019 Seattle Market Report

Heating Up!

Stats for the Seattle real estate market for February 2019 are out, so here’s the market update condensed into some highlights.

- Pending sales are down about 14 percent compared to February 2018.

- Inventory in Seattle rose from January to 1.8 months (0-3 months of inventory is considered a seller’s market).

- Median prices increased compared to January but were still down compared to February 2018.

- Median sale prices in Seattle:

- residential – $730,000 (down 6% compared to Feb 2018)

- condo – $444,000 (down 14% compared to Feb 2018)

- combined – $690,000 (down 3% compared to Feb 2018)

- 47% of homes took a price cut before selling, with 20% selling above list price. Compare that to February 2018 when only 14% took price cuts before selling and 64% sold over the asking price!

- We are seeing more homes go under contract than new homes coming on the market.

- We are seeing more offer review dates.

- Homes that are priced well are getting multiple offers.

As we continue towards the spring market (the busiest time of year for buyers and sellers), I think we’ll see a lot of buyers taking advantage of low interest rates but they may be competing for homes due to the limited choices.

If you’d like to see market update graphs that are updated each month, check out the market update section of my website.

Sewer Scope

What am I looking at?

This is the view from a video camera during a recent sewer scope of a townhouse in Ballard. The camera went through over 100 feet of sewer line on the property before finally hitting the main sewer line out in the street. To our surprise, it was cavernous and brick-lined! Not a common sight. We suspect it was a large convergence in the intersection, under a manhole cover.

What is a sewer scope?

A sewer scope is an inspection that you have done by a professional before you buy a house. Basically, a wire is fed down the drain and into the sewer line of a house. The wire has a video camera on the end of it so you can see the condition of the sewer as you go down.

Why do I need a sewer scope?

This is part of you doing your due diligence in ensuring there are no major problems with the sewer line. The relatively low cost of the inspection is worth it, especially if big problems turn up. Even if there are no obvious signs of backups or leaks, it’s always a good idea to consider getting a sewer scope.

Here are some things the inspector will check for:

- structural damage like cracks and breaks

- root intrusions

- grease or other buildups

- dips in the pipe, which can cause pooling and backups

Some smaller problems can be solved by using a roto rooter. However, because sewer lines are buried and not easily accessible, bigger problems like replacing sewer lines can cost a lot of money, especially if the street has to be dug up.

Hopefully, no problems show up but it’s always a good idea to check!

Let me know if you have any questions or want to know more about sewer scopes.

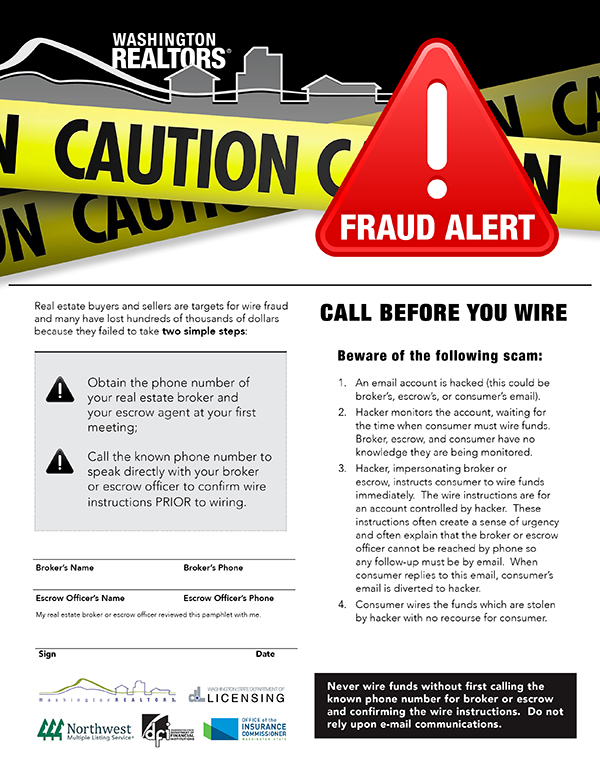

Wire Fraud: Be Aware!

Wire Fraud On the Rise

Wire fraud has been on the rise in the past few years. Since real estate is an industry where large amounts of money are involved, many scammers are increasingly devoting their efforts to target home purchases. According to the FBI, cyber-criminals stole or tried to steal about $19 million from real estate transactions in 2016. That number went up to almost $1 billion in 2017. That’s a huge jump for one year.

What Is Wire Fraud?

Wire fraud is when criminals steal money by having people wire, or send, money to a fraudulent account. How do they do this? They usually find ways to pose as an agent, escrow officer, or mortgage lender. They hack into email accounts and monitor email exchanges between parties to learn important details about the transaction. Then, at the perfect moment, the criminals jump in and send doctored emails to look exactly like they came from a trusted source. They give instructions for the money to be wired to a specific (fraudulent) account. Once the sender wires the money, there’s almost no way to trace it or get it back. The money is gone forever and the scammers get away.

Close to Home

We often see or hear these stories online but it recently happened close to home. A few weeks ago, some clients of an agent in our office lost their earnest money of $20,000 to fraudsters. Sometimes, people lose hundreds of thousands of dollars.

Our agent had had multiple conversations about only writing a check for the earnest money and not wiring it. However, 30 minutes after a real email from our agent, scammers sent an email from a fake address that was very similar to the agent’s. It had all the correct formatting and contained knowledge of the transaction. The email also contained “updated instructions” for wiring the earnest money, which the buyers followed.

It turned out the buyers’ email address had been hacked and the criminals had been watching the interactions, waiting for the perfect moment to slip in. Even if it only pays off one out of 100 times, there’s lots of money to be made and little risk of getting caught.

Ways to Stay Safe

- Don’t wire money! Write a check if you can. I know it seems like we’re going backwards here, but it truly is the safer option.

- If you have to wire money, ALWAYS verify instructions in person or over the phone with a person that you already know, through a phone number that you already know. Be especially wary of wire instructions sent via email

- Make sure you have strong passwords.

- Don’t share personal information in emails.

- Don’t click on suspicious links or emails.

Please don’t become a victim of these criminals! The best defense is strong communication with your agent and being educated. The form below is something every agent should give you at the beginning of your agency relationship! Let me know if you have any questions or comments.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link